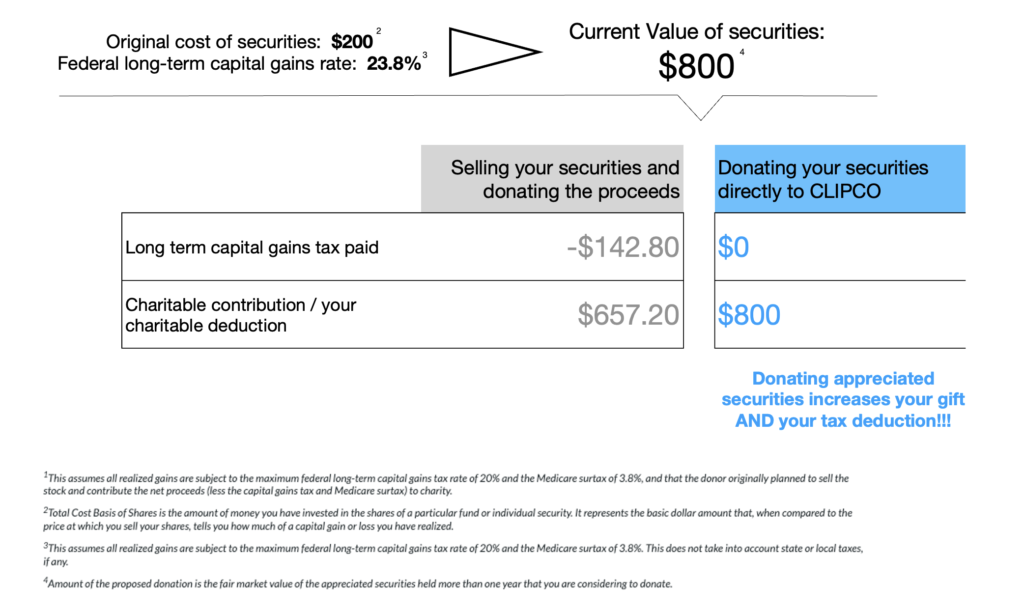

CLIP accepts stock transfers in lieu of cash donation. It’s simple and easy. When you donate stock to charity, you’ll generally take a tax deduction for the full fair market value. And because you are donating stock, your contribution and tax deduction may instantly increase over 20%1. Would you prefer to donate bonds or mutual funds? The same benefits apply.

Donation Instructions:

- Log in to your brokerage and initiate a direct transfer of stock to CLIPCO using the information below:

- DTC: 0141

- Account Number: 3963-4385

- Account Name: CLIPCO

- Receiving Firm Name: “Wells Fargo Clearing Services, LLC”

- Send email to treasurer@cusdclipco.org including the following information:

- Your name

- Child’s name

- Child’s grade and room number

- Donated stock name

- # Shares donated

- To receive participation credit: please go to Cheddar Up donation site and select “Check / Cash” donation, fill out information and submit.

- Donation receipt will be emailed to you by our treasurer once the securities have been received and verified.

Please consult with your tax advisor to determine whether your donation is tax deductible in whole or in part. Nothing in this communication is intended to constitute legal or tax advice.